DEX Features

The following functionality is provided by the first ShimmerSea DEX version:

Exchange

The exchange feature enables the exchange of tokens based on smart contracts (AMM liquidity pools) without the need for a party to facilitate the exchange as a middleman.

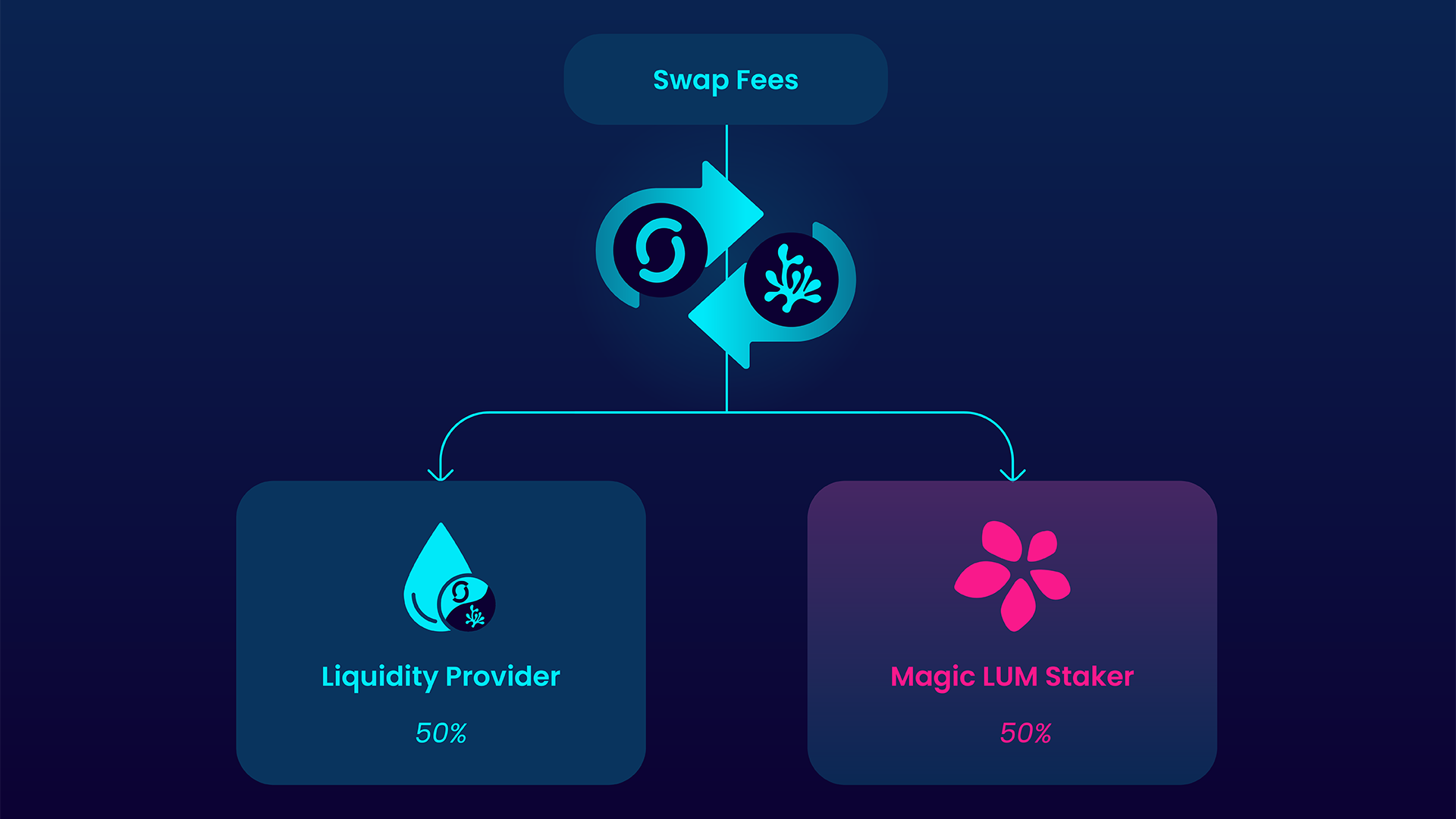

Only tokens can be exchanged for which there is also a liquidity pool (See paragraph Liquidity). For each exchange fees are automatically deducted from the traded currency, out of which 50% go to liquidity providers, 25% are used for buying and burning of the $LUM token and 25% are used to build up Protocol Owned Liquidity. The total amount of fees can be different depending on the pool. The default fees are set to 0,3%.

Liquidity

Liquidity for trading is not provided by Blue-Labs, ShimmerSea DAO or a sole third party, but by many liquidity providers. Anyone can be a Liquidity Provider by directly interacting with smart contracts and without the need to ask for permission. As a Liquidity Provider, you get a share of the trading fees collected and can participate in farming (if possible).

The liquidity for a token pair can be provided for a liquidity pool and in return you get a so-called LP token (Liquidity Provider Token). Liquidity is always added in the form of two tokens with a 1:1 value share at the time of allocation. Consequently, the LP token reflects the share of tokens provided in the liquidity pool. Ownership of an LP token also entitles the holder to a share of the exchange fee distribution. These are paid directly into the pool and are only realized once the LP tokens are redeemed and thus leave the liquidity pool. The LP tokens can be used at any time to retrieve the liquidity provided. However, when the LP token is redeemed, it might not be the same amount of the two tokens that was initially allocated, but the share of the pool that the LP token represents. Depending on how the price ratio of the two tokens has changed from deposit to payout, a so-called Impermanent Loss as well as Permanent Loss may occur. Liquidity pools can be freely opened by anyone.

Farming

The so-called liquidity farms offer an additional reward system for the liquidity providers. For certain token pairs, there are created farms on which the reward token is distributed.

The LP tokens obtained by providing liquidity can be contributed to an LP token-specific farm. In return, a reward token will be paid out. The reward can be paid out with the protocol's own token such as LUM or partner token or both. Each farm is assigned a Reward Token Multiplier, which indicates how many LUM tokens are allocated (mined) for that farm. Higher multiplier, higher rewards. The amount of LUM distributed is a fixed amount. The more LP tokens put into a farm, the lower the percentage return per LP token. The ShimmerSea DAO can adjust the multiplier to optimize the reward system of the DEX.

The annual return is usually expressed as APR (Annual Percentage Rate) or APY (Annual Percentage Yield). Everyone can see how many LUM tokens are distributed in relation to the stake (measured in dollars).

Staking Pools

In addition to the Farms, there are also "Staking" Pools. With a staking pool ShimmerSea creates an incentive to hold a certain token longer and earn rewards. For example, the LUM Pool can be used to stake the earned LUM Tokens and earn even more LUM Tokens as Reward. So there is an incentive to hold this certain token and not to sell it.

The difference between a farm and a staking pool is that instead of LP tokens, which represent a trading pair, individual tokens can be staked in this pool. LUM tokens are also distributed as rewards. For a farm, two tokens must always be linked, resulting in an LP token, which can then be farmed. Thus, the impermanent loss is always given as a risk in farming. Since only single tokens are directly staked in a Staking Pool, there is no impermanent loss risk. Different Staking Pools can be deployed at ShimmerSea:

- Stake Native reward token -> Earn Native reward token

- Stake Native reward token -> Earn Partner Token

- Stake Partner Token -> Earn Partner Token

Some staking pools can even be access restricted by NFTs or distribute several reward tokens at the same time.

Boost

For ShimmerSea the Booster is a tool to provide the users access to the Governance Token "Magic LUM '' on the one hand and to establish an innovative burning mechanism for LUM on the other hand.

The booster gives the possibility to upgrade the earned LUM Token (Reward Token) to Magic LUM (Governance Token) (see paragraph Magic LUM Token). To do this, LUM Tokens must be placed in the booster and Magic LUM will be distributed in return. However, since this is a so-called refinement process, the LUM tokens placed in the booster are burned over time on a percentage basis. That means, depending on how long the Booster is used, a part of the deposited LUM will be burned. The deposited LUM tokens are locked for 72h. Thus, the user must be aware that in any case a certain percentage of his deposited LUM tokens will be destroyed. Using the Emergency Withdraw function, the LUM Token can be withdrawn even during this locked period, but this leads to a direct 20% Burn penalty.

The monthly return in Magic LUM Token is indicated with MPR (Monthly Percentage Rate). It makes sense here to go to a monthly view, since all deposited LUM tokens are converted into Magic LUM within a month.

ShimmerSea NFT Marketplace

The NFT Marketplace is a cornerstone of the ShimmerSea offering. Projects can list their collections for trading and earn royalties for every NFT trade of their collection. Further, projects can benefit from the functionality to open NFT restricted staking pools! This is a way for projects to distribute rewards to the community in a fully decentral yet targeted way. Only owners of the NFT will be able to join the staking pool.

ShimmerSea and its community is benefiting from the NFT Marketplace even further. The NFT Marketplace takes between 2.5% and 5% trading fees. However, these fees flow back to the community in full. All trading fees earned by the NFT Marketplace will be used to buy back and burn LUM. This way the entire ShimmerSea ecosystem benefits from every trade made on the marketplace.

Security

Security is one of the most important aspects in the technology area of ShimmerSea. Since this is a decentralized fully automated smart contract protocol, the same applies here:

"Code is law!"

For this reason, the ShimmerSea DEX code is put through its paces before launch. The testing includes an initial scan by the AuditOne platform and a full audit by Hashex, a dedicated external team. The audit report will be publicly available on our ShimmerSea Docs page.

Powered by BlueLabs

Powered by BlueLabs